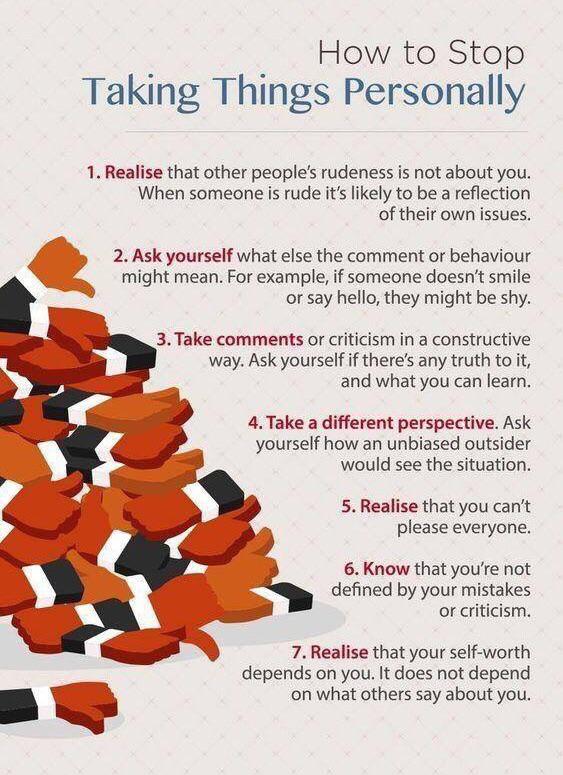

Essential Ways to Cultivate Self-Love in 2025 Self-love is a fundamental aspect of our emotional well-being and mental health. In today's fast-paced world, it is more important than ever to prioritize self-acceptance, self-esteem, and self-care practices. As we navigate through the challenges of life, nurturing compassion for ourselves can lead to emotional resilience, personal growth, and a deeper inner peace. This...

How to Make Sopa de Fideo: An Easy and Flavorful Fun Recipe Sopa de fideo is a traditional Mexican noodle soup that has warmed hearts and homes for generations. It is a delightful dish that is simple to prepare and can easily be adapted to suit various tastes, making it a favorite among families. This soup is nutritious, packing a punch...

Effective Strategies for Breaking Up with a Partner You Live With in 2025 Breaking up is never easy, but when you’re living together, the situation can become even more complicated. In 2025, managing the emotional and logistical challenges while navigating shared spaces and responsibilities is crucial. This article provides effective ways to break up with someone you live with, focusing on...

Effective Ways to Bake Meatloaf at 350 for Perfect Results Baking meatloaf at 350°F is a classic method that yields delicious results, making it a staple for many families. Understanding how long to bake meatloaf is essential for achieving that perfect texture and flavor that everyone loves. Meatloaf cooking time can vary based on the thickness and ingredients, so it’s crucial...

Effective Guide to Using Miralax for Quick Relief Miralax, an osmotic laxative, is well-known for its ability to relieve constipation effectively. In 2025, understanding how to use Miralax properly can provide fast relief and enhance bowel health. This guide will delve into Miralax dosage, preparation, safety instructions, and potential side effects. With its popularity as a go-to treatment for constipation, Miralax not...

Effective Strategies for Managing Stage 3 Kidney Disease Progression As we progress into 2025, it is imperative to address the complexities of managing stage 3 kidney disease progression. With approximately 15% of the global population affected by chronic kidney disease (CKD), understanding the factors influencing its progression becomes crucial. Stage 3 of kidney disease indicates a significant decline in renal function...

Effective Ways to Steam Broccoli for Improved Nutrition Overview of Steaming Broccoli Steaming broccoli is a rapid and healthy cooking method that effectively preserves the vegetable's nutrients. When compared to boiling or frying, steaming broccoli allows you to enjoy its vibrant green color and crunchy texture, maximizing both its appearance and health benefits. This technique involves cooking broccoli using steam generated from...

Essential Guide to Increasing Ejaculation Volume in 2025 Semen volume is an often overlooked aspect of male sexual health, yet it's crucial for fertility and overall sexual experience. Many men are keen to discover how to cum a lot, looking for ways to increase ejaculation volume through various methods. Understanding the importance of improved ejaculation can lead to enhanced sexual pleasure,...

Essential Guide to How to Make Bows Effectively in 2025 Making bows is an art that can elevate any gift, decoration, or event, providing a touch of elegance and personal flair. In 2025, this skill has not only become a popular craft but also a significant means of expression in both casual and festive contexts. Whether it’s for birthdays, holidays, weddings,...

Essential Methods for Preserving Basil Effectively Preserving basil is a crucial skill for culinary enthusiasts, especially to maintain the herb's vibrant flavor and aroma long after the harvest season. For the ambitious cook, knowing how to dry basil, freeze it, or utilize basil in its various forms ensures that this beloved ingredient can continue to enhance your dishes well into 2025...