Effective Ways to Calculate Retained Earnings in 2025: Discover Key Formulas and Tips

Understanding how to find retained earnings is crucial for any business, whether you are a startup or an established corporation. Retained earnings represent the cumulative profit a company has reinvested in its operations rather than distributed to its shareholders as dividends. This article explores the retained earnings formula, the calculations involved, and the significance of retained earnings in your financial statements, including practical steps and tips for effective management. Let’s dive into the fundamentals and nuances of retained earnings.

Retained Earnings Overview

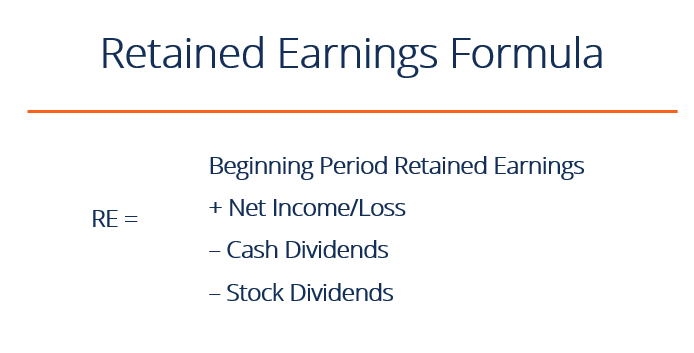

To fully grasp retained earnings, it’s essential to start with a clear definition. Retained earnings are a key component of shareholder equity, representing profits kept within the company. They are typically calculated from figures in the financial statements, providing insights into a company’s financial health and growth potion. Understanding retained earnings can help in decision-making, particularly for investors assessing a company’s potential for growth. The retained earnings formula can be derived as follows: Retained Earnings = Prior Period Retained Earnings + Net Income – Dividends. This provides a basic overview of how to track retained earnings from one period to the next.

What is the Retained Earnings Function?

The retained earnings function is significant for multiple reasons. It reflects how much profit a company has chosen to reinvest rather than distribute to shareholders, which can indicate the management’s confidence in future growth. A pattern of increasing retained earnings can be seen as a sign of healthy profits and wise financing decisions, essential for long-term planning. Conversely, if a company consistently posts low or negative retained earnings, it may suggest operational difficulties or insufficient profitability over time.

Importance of Retained Earnings for Small Business

For small businesses, the role of retained earnings is vital. They serve as a source of internal financing, allowing the company to fund new projects without incurring debt. Many small business owners leverage retained earnings to invest in assets, product development, and marketing strategies, which enables them to expand operations. The retained earnings statement plays a key role in depicting these values, giving stakeholders insight into the company’s reinvestment strategies.

Common Misconceptions About Retained Earnings

A common misconception about retained earnings is that they are synonymous with cash on hand. In reality, retained earnings reflect historical earnings that have been reinvested, not liquid assets. Additionally, potential investors might overlook retained earnings when analyzing a firm’s profitability, instead focusing solely on dividends or current earnings. Recognizing this distinction is crucial for stakeholder assessments and for understanding the broader implications of a company’s financial strategies.

How to Calculate Retained Earnings

The retained earnings calculation steps are straightforward but require diligence to ensure all relevant figures are accurately outlined. The fundamental approach includes starting with prior period earnings, adding the net income for the current period, and subtracting any dividends paid out.

Steps for Calculating Retained Earnings

To calculate retained earnings accurately, follow these steps:

- Record prior period retained earnings from your last balance sheet.

- Add the net income obtained from the income statement for the current fiscal period.

- Subtract any dividends declared or paid to shareholders.

- The result will give you the updated retained earnings figure.

This method allows for transparent tracking of retained earnings across various reporting periods, ensuring that stakeholders have a comprehensive understanding of profit retention and business strategy.

Retained Earnings Calculation Example

Let’s illustrate the retained earnings formula with a simple example. Suppose a company had $100,000 in retained earnings at the end of last year. During the current year, the business generated a net income of $50,000. If the company declared dividends of $20,000, the calculation would look like this:

Retained Earnings = Prior Retained Earnings ($100,000) + Net Income ($50,000) – Dividends ($20,000)

This results in retained earnings of $130,000 for the current year. Understanding how to calculate retained earnings through such examples facilitates better financial planning and boosts overall strategic growth.

Tracking Changes in Retained Earnings

Another critical aspect to consider is how to track retained earnings over time. Maintaining accurate accounting records and financial reporting is essential for this analysis. Utilizing tools such as Excel spreadsheets can help in tracking changes efficiently. In your sheets, you can include columns for previous retained earnings, net income, dividends, and resulting retained earnings for clear historical comparisons. This tracking not only underscores historical profit retention but also lays the groundwork for calculating retained earnings in future periods.

The Role of Retained Earnings in Accounting

In the context of accounting principles, the impact of retained earnings extends beyond mere calculations; they influence financial strategy and reporting. A well-prepared retained earnings statement should accompany other financial documents, giving a complete overview of the company’s equity and financial health.

Retained Earnings on Balance Sheet

When analyzing financial statements, retained earnings appear on the balance sheet under shareholder’s equity. This position reflects the company’s total equity after accounting for dividends distributed to investors. Specifically, it provides insight into how, at any given time, profits have been allocated within the company. These figures can also indicate the financial stability of a company and its approach to managing shareholder returns.

Retained Earnings and Dividends

The relationship between retained earnings and dividends is an essential aspect of corporate finance. When dividends are paid out, they reduce retained earnings, signaling that management chooses to distribute profits rather than reinvest them. This allocation affects share value and perceptions of financial growth potential. Balancing dividends and retained earnings is crucial for maintaining investor confidence while also fostering long-term corporate strategies.

Retained Earnings Impact on Shareholders

Retained earnings have a direct impact on shareholders since they can reflect the company’s growth potential and sustainability. A healthy balance of retained earnings usually returns profitable growth, which can appreciate stock value and provide dividends down the line. Investors weighing retained earnings against cash flow and net income can evaluate whether a company leverages profits effectively to ensure ongoing success.

Improving Retained Earnings in Your Business

The significance of retained earnings lies in their ability to contribute to business growth and absorption of losses. It’s crucial for management to understand the impacts of decisions made regarding retained earnings, such as reinvestment strategies or dividends. There are propositions to ensure continued improvement and growth of retained earnings, which will, in turn, stabilize the company financially.

Strategies for Boosting Retained Earnings

To enhance retained earnings, companies may implement the following strategies:

- Increase net income through effective product pricing, enhanced sales strategies, or cost reductions.

- Minimize or strategically adjust dividends based on income fluctuations or reinvestment needs.

- Forecast and analyze returns on investment to predict how retained earnings might affect the future.

These strategic steps ensure a balancing act between maintaining attractive returns for investors while investing in the company’s long-term growth.

Retained Earnings Management Practices

Implementing effective management practices can greatly improve retained earnings. This involves regular monitoring and evaluating of financial performance, operational efficiencies, and variable control measures. Conducting periodic retained earnings analysis can provide essential insights and possible adjustments for improving financial performance.

Understanding Retained Earnings for Elevated Financial Health

By ensuring all stakeholders understand retained earnings and their implications, businesses can more effectively communicate their growth strategies. This understanding guides responsible financial behavior, both from organizational leadership and shareholders looking for sustainable investment avenues. The focus on retained earnings as part of broader corporate finance principles reinforces the need for thoughtful, strategic planning.

Key Takeaways

- Retained earnings help assess company reinvestment strategies and long-term growth potential.

- Effective calculation is based on simple formulas incorporating net income and dividends.

- Monitoring and tracking retained earnings are vital for informed financial strategies.

- Retained earnings significantly influence shareholder equity and overall corporate strategy.

FAQ

1. What is the difference between retained earnings and net income?

Retained earnings represent the cumulative profits retained within the company, while net income is the profit earned during a specific accounting period. Essentially, net income contributes to changes in retained earnings during each fiscal period, reflecting operational performance more than the historical perspective of retained earnings.

2. How can mistakes in retained earnings affect a business?

Mistakes in retained earnings can lead to misrepresentation of a company’s financial health, potentially affecting investor decisions, operational budgeting, and compliance reporting. These inaccuracies might impact dividends, causing stakeholder distrust and adverse decisions regarding financing or expansion strategies.

3. Why is retained earnings important for small businesses?

For small businesses, retained earnings are critical as they represent self-financed growth opportunities. By reinvesting profits, small businesses can avoid taking on debt while still funding operational enhancements or expansions, which can lead to long-term sustainability and profitability.

4. How do retained earnings affect equity?

Retained earnings contribute to equity as they are included in the shareholder’s equity section of the balance sheet. A higher figure suggests increased capacity for business investment, reflecting positively on the company’s ability to generate returns for investors over time.

5. What are retained earnings tracking methods?

Retained earnings can be traced through accounting software, manual financial tracking methods, or spreadsheets like Excel. Regularly updating and reviewing these accounts helps ensure accuracy and provides insights into a business’s financial development, enabling proactive decision-making.

6. How can a company improve its retained earnings?

Companies can improve retained earnings by increasing net income through better sales strategies, controlling costs, and optimizing cash flow. Adjusting dividend policies to prioritize reinvestment can also significantly enhance retained earnings over time.

7. Is retained earnings equal to cash available for reinvestment?

No, retained earnings reflect the total cumulative profits retained and reinvested, not the cash available at any point in time. A company might have a high retained earnings figure but still face cash flow issues, underscoring the importance of managing working capital alongside profits.