“`html

How to Become an Accountant: Essential Steps to Achieve Your Professional Goals in 2025

Embarking on a journey to become an accountant is both exciting and challenging. An accounting career path offers various opportunities in public, private, and corporate sectors. This guide will provide you with the essential steps to reach your accounting goals by 2025, helping you understand the qualifications, certifications, and skills necessary for success in today’s evolving accounting landscape.

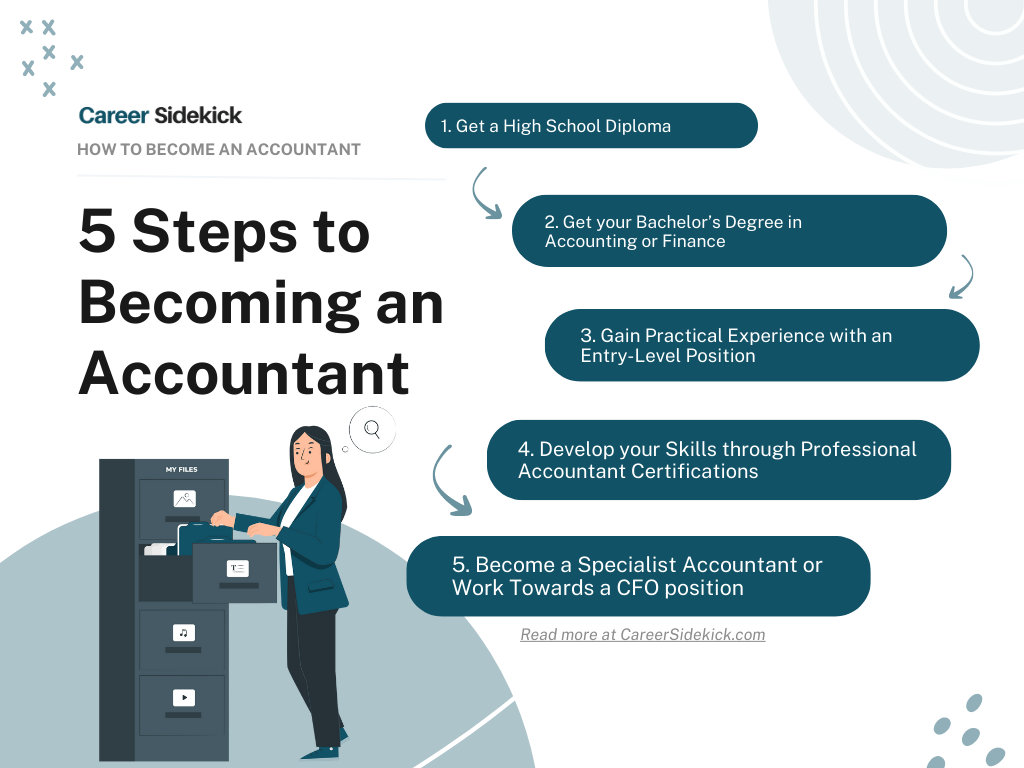

Understanding Accountant Qualifications

To begin your journey of **how to become an accountant**, grasping the necessary qualifications is crucial. Generally, an accounting degree is required, which can be a bachelor’s or even a master’s degree in accounting or finance. Most employers prefer candidates who have completed accredited accounting programs. For instance, courses covering **financial accounting**, **cost accounting techniques**, and **management accounting** empower you with foundational knowledge. Having a **financial analysis** background further enriches your capability in the field.

Accounting Degrees and Certifications

Choosing the right accounting degree, like a Bachelor in Accounting or Finance, can significantly impact your career trajectory. Additionally, pursuing accounting certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant) is often mandatory in public accounting. Preparing for the CPA exam is a rigorous process that involves foundational courses in financial statements analysis, tax accounting, and auditing fundamentals. Completing these credentials enhances your expertise, opens up accounting job opportunities, and can lead to a higher salary compared to non-certified accountants.

Essential Accounting Skills

Accountants need a diverse skill set that includes technical competencies as well as soft skills. **Communication skills for accountants** are essential when presenting financial information to clients or stakeholders. Analytical skills development, understanding financial risks, and knowledge of regulatory compliance also play a vital role in professional growth. Moreover, familiarity with **accounting software** and technologies such as AI and automation tools enhances productivity and accuracy in accounting practices. Engaging in accounting workshops or online courses can help sharpen these essential skills.

The Role of Internships and Networking

Gaining practical experience through accounting internships is a critical step in your path toward becoming a successful accountant. Internships provide real-world exposure to daily accountant responsibilities and enhance your understanding of financial regulations and auditing standards. They not only bolster your resume but also enrich your professional network – an invaluable asset in career advancement in accounting.

Benefits of Accounting Internships

Interning offers numerous benefits, such as hands-on experience in **accounting principles**, real-time financial reporting, and exposure to client management. For instance, during internships, you might learn to prepare financial statements, engage in budgeting and forecasting tasks, or develop **banking and bookkeeping** expertise. These experiences lay the groundwork for developing job-ready skills, and often lead to job offers by accounting firms.

Professional Networking in Accounting

Building a network is essential in the accounting world. Join professional accounting organizations and attend industry conferences to connect with experienced accountants. Engaging in networking opportunities helps you stay updated on trends in accounting, including international accounting standards and emerging technologies. Leveraging social media platforms like LinkedIn can enhance your professional visibility and expose you to diverse **accounting job opportunities**.

Preparing for Accountant Responsibilities

Understanding the diverse responsibilities of accountants is vital. Some roles might pertain to **tax preparation services**, while others focus on auditing or forensic accounting. Each of these areas requires specific knowledge of tax regulations and bookkeeping processes. Knowing what to expect in your role as an accountant will better equip you for your workload and client interactions.

Role of Financial Analysis

Financial analysis is a cornerstone of an accountant’s job. It involves preparing financial reports that help organizations in making informed business decisions. Techniques like **budgeting and forecasting** are crucial here, as accountants must predict potential financial challenges while advising on resource allocation effectively. Familiarize yourself with how to interpret **financial dashboards** to translate complex data into concise insights.

Importance of Ethical Standards

Maintaining ethical standards in accounting is critical. Accountants are expected to uphold integrity and transparency when managing clients’ financial affairs. Issues like **ethical dilemmas** and tax compliance require accountants to navigate complex situations. Continuing professional education on these standards can significantly adapt your ethics to the changes in the accounting industry and ensure your advice aligns with **accounting regulations**, impacting your reputation and career growth positively.

Future Trends in Accounting

As technology evolves, the accounting field is shifting dramatically. Trends such as **cloud accounting**, AI integration, and automation are transforming traditional accounting roles. Understanding how to leverage these technologies can set you apart in the job market. Keep abreast of emerging **accounting technologies** that improve efficiency, accuracy, and client satisfaction.

Impact of Technology on Accounting Careers

Technology is revolutionizing how accountants operate, especially in areas like data analysis, compliance, and client interaction. For instance, utilizing software tools for **financial reporting standards** allows for sophisticated data manipulation and real-time projections. Embracing these advancements while adapting your **business finance** strategies will keep your skills relevant and enhance your employability.

Career Planning for Accountants

Strategic career planning will enhance your prospects in accounting. Focus on continuous professional education and look for roles that align with your long-term goals. Specializing in fields like tax accounting or forensic accounting can also lead to substantial career growth and higher earnings. Additionally, diversifying your skill set by engaging in **remote accounting jobs** or **accounting workshops** can broaden your professional horizons.

Key Takeaways

- Obtain the necessary accounting degrees and certifications like CPA or CMA.

- Participate actively in internship programs for hands-on experience.

- Network extensively to broaden your industry knowledge and job prospects.

- Stay updated on technological advancements in accounting for future opportunities.

- Invest in continuous professional education to promote ethical practices and career growth.

FAQ

1. What are the most significant challenges faced by accountants today?

Accountants today face challenges such as evolving tax regulations, automation taking over traditional functions, and the demand for stakeholders for transparency and ethical practices. Also, adapting to the impact of technology on the accounting profession requires continuous learning and significant adjustment in skill sets to remain competitive.

2. What are the differences between public and private accounting?

Public accounting involves providing accounting services to various clients such as individuals and businesses, focusing on areas like tax accounting and financial auditing. Private accounting, however, refers to accountants working within a specific company and managing internal financial processes. Understanding these differences is essential when pursuing an accounting career path.

3. How can I effectively prepare for the CPA exam?

Effective CPA exam preparation includes completing relevant coursework, enrolling in preparatory courses, and using practice exams to familiarize yourself with the exam format. Developing a study schedule that covers all exam topics, like auditing fundamentals and financial accounting, will ensure you are well-prepared.

4. What skills are essential for success in accounting?

Critical skills for accountants include strong analytical abilities, attention to detail, proficient use of accounting software, communication skills, and knowledge of ethical standards in accounting. Emphasizing these skills will significantly increase your job prospects and performance in accounting roles.

5. How do I find remote accounting jobs?

Finding remote accounting jobs can be done through online job platforms, professional networks, or by joining accounting organizations that promote remote opportunities. Utilize professional networking sites and job boards that specialize in accounting roles to explore available options in telecommuting positions.

6. What are the accounting principles one must know?

Essential accounting principles to understand include the consistency principle, prudence principle, matching principle, and the complete disclosure principle. Familiarity with these principles allows accountants to prepare accurate financial statements that adhere to accounting standards.

7. How important is continuing professional education for accountants?

Continuing professional education is vital in accounting as it helps professionals stay informed on changes in accounting standards, regulations, and technologies. It enhances your knowledge, supports ethical practices, and can subsequently lead to promotions or advancements in your career.

“`