Smart Ways to Build Business Credit in 2025

In today’s competitive environment, establishing a robust business credit profile has become essential for sustained growth and credibility. The ability to build business credit not only opens doors to better financing options but also plays a pivotal role in shaping a business’s creditworthiness. This article delves into effective strategies to enhance your business credit score, making it easier to secure loans, lines of credit, and more favorable terms with vendors.

Understanding Business Credit

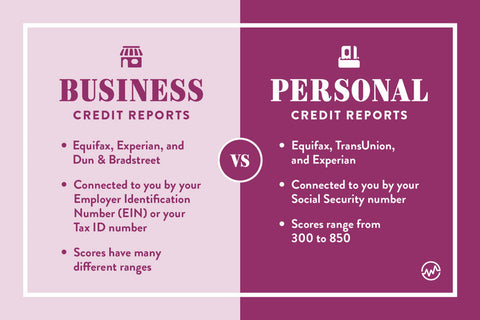

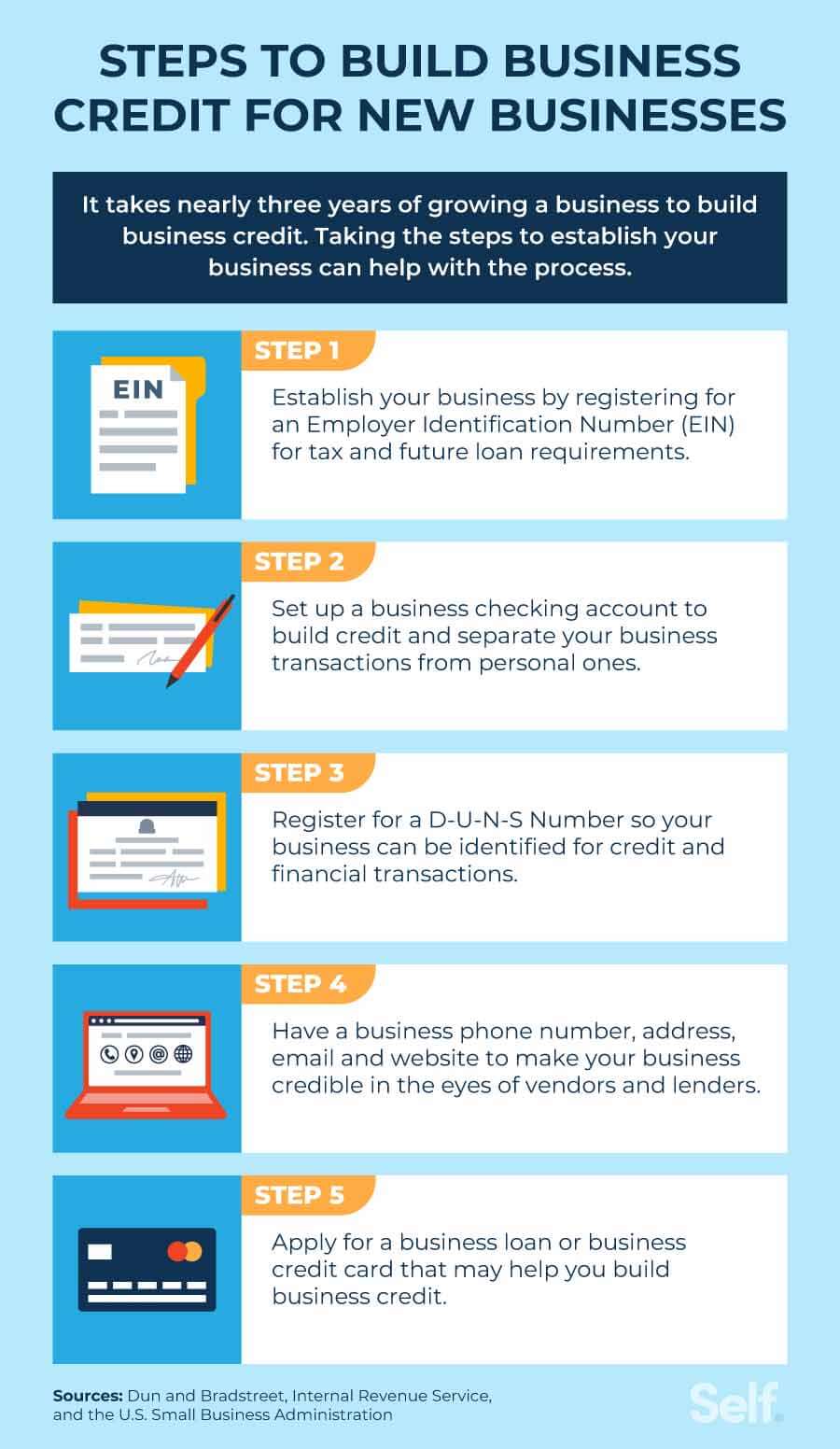

Before diving into strategies, it’s crucial to understand how business credit works and its importance. Establishing business credit means ensuring that your business is recognized as a separate entity from its owners in the eyes of lenders and credit reporting agencies. This separation safeguards personal assets and enhances the credibility of the business.

What Makes Up a Business Credit Score?

Your business credit score is influenced by various factors, including payment history, outstanding debt, and the duration of your credit relationships. For example, timely payments significantly boost your score, while high business credit utilization might hurt it. Understanding these factors allows business owners to develop strategies for improvement and aligns with their financial goals.

The Importance of a Business Credit Report

<pA comprehensive business credit report gives lenders and suppliers an insight into your company’s financial responsibility. This document details how much credit you’ve used, your payment patterns, and even whether any collections accounts have been previously reported. Keeping a close eye on your report can illuminate adjustments needed for improving business credit.

Common Mistakes When Building Business Credit

One pitfall many small business owners encounter is neglecting to separate personal and business credit accounts. Mixing these can damage your business credit profile and hinder access to essential financing. Other mistakes include ignoring credit monitoring and not disputing inaccuracies on your credit report which can degrade your creditworthiness.

Effective Strategies for Building Business Credit

With a foundational understanding of business credit, let’s explore actionable strategies that can bolster your business credit history, ensuring better financial health and operational flexibility.

Open a Dedicated Business Bank Account

Establishing a dedicated business bank account is one of the first steps you should take in building business credit from scratch. It not only helps to separate personal finances from business activities but also improves your credibility with lenders. Consistently maintaining this account, and using it for all business transactions, aids in the tracking of financial health over time.

Utilize Vendor Credit Wisely

Utilizing vendor credit can be an excellent means of establishing lines of credit under your business’s name. Partnering with suppliers who report credit to agencies can positively impact your business credit lines. Ensure that all transactions are paid on time to enhance your credit profile.

Leverage Business Credit Cards

Business credit cards can be powerful tools when used correctly. These cards not only help manage expenses but also help build business credit with timely payments. For instance, utilizing a rewards card for regular business expenses and paying it off monthly can enhance your overall financial standing and credit score.

Monitoring and Managing Business Credit

Monitoring and managing your business credit is crucial for sustainable growth. Implementing a structured approach to overseeing your credit activities ensures that you are always aware of your business’s financial health and can make informed decisions.

Business Credit Monitoring Services

Using business credit monitoring services can provide real-time insights into your credit report. These services alert you to changes that might indicate fraud or errors. Additionally, they can equip you with tools and resources to swiftly rectify any discrepancies, protecting your business credit history.

Keep Detailed Financial Records

Ensuring meticulous records of your company’s financial transactions helps not only in managing cash flow but also in tracking your progress toward establishing business credit. By maintaining a transparent business financial history, you can more easily showcase your creditworthiness to potential lenders when applying for business credit.

Regularly Review Your Business Credit Reports

Periodically checking your business credit report allows you to understand trends and pinpoint areas for improvement. It might also uncover information that shouldn’t be there. Correction of errors can help enhance your score, reflecting accurate payments and financial behaviors that align with the perceptions lenders have about you.

Key Takeaways on Building Business Credit

- Establishing a dedicated business bank account is critical for separating personal and business finances.

- Utilizing vendor credit can enhance your business credit score if managed properly.

- Monitor your business credit reports regularly to maintain an accurate and favorable credit profile.

FAQ

1. Why is business credit important for small businesses?

Establishing business credit impacts the ability to secure business financing, influences loan interest rates, and affects negotiation strength with suppliers. It helps access capital while keeping personal finances separate, safeguarding personal assets.

2. How can I check my business credit score?

You can check your business credit score by requesting a report from credit reporting agencies such as Dun & Bradstreet, Experian, and Equifax. Many offer services that allow business owners to monitor their scores and rectify any errors with their credit reports.

3. What are trade lines, and how do they impact business credit?

Trade credit often refers to accounts with suppliers or vendors that allow you to purchase goods or services on credit. Establishing positive trade lines with timely payments is a substantial method to boost your business credit history.

4. Can I build business credit without personal guarantees?

Yes, it’s possible to establish business credit without personal guarantees by opening credit accounts that only rely on your business’s creditworthiness. Achieving this typically requires an established business credit profile.

5. How often should I monitor my business credit reports?

It’s advisable to monitor your business credit report at least quarterly. This regular oversight enables proactive management of your credit profile and allows early detection of any discrepancies or fraudulent activities.

6. What are the risks of ignoring business credit?

Neglecting to build or monitor business credit can lead to higher interest rates on loans, difficulty securing credit, and opportunistic decisions by lenders based on inadequate information, potentially harming the overall financial health of the business.

7. How does having a strong business credit score benefit my business in the long run?

A strong business credit score facilitates easier access to funding, lowers costs of credits, broadens financial opportunities, and positions your business favorably in negotiations with suppliers and service providers.

Incorporating these insights and strategies into your business practices will undoubtedly lay a strong foundation for your business credit in 2025 and beyond.