How to Effectively Cancel Zelle Payment in 2025: Simple Ways to Get Your Money Back

In the fast-paced world of digital transactions, knowing how to cancel a Zelle payment is crucial for anyone using this popular peer-to-peer payment system. Whether you have accidentally sent money to the wrong recipient or experienced a “damaged Zelle transaction,” it’s essential to understand the Zelle payment cancellation steps available in 2025. This article will guide you through effective methods for resolving Zelle payment issues, ensuring that you can easily navigate any financial mishaps.

Understanding Zelle Payment Procedures

Before delving into how you can cancel a Zelle transaction, it’s important to familiarize yourself with the Zelle payment procedure. Zelle operates via banks and credit unions that support the service, allowing various payment transactions without requiring extra apps. Understanding the underlying process is essential when it comes to managing Zelle payments and disputing any transaction errors. Should you find yourself in a situation where you need to revoke a Zelle payment, being aware of the exact Zelle procedures will streamline your efforts significantly.

What to Know About Zelle Transaction Security

When using Zelle for digital payments, transaction security should always be a priority. Each Zelle payment is encrypted and processed through your bank’s existing security measures. However, there are still potential issues, such as sending money to the wrong recipient. To prevent unauthorized transactions, enable notification alerts, and keep an eye on your transaction history. In case of fraud, learn how to dispute Zelle payments with your bank, ensuring your financial safety.

Recent Updates to Zelle Policies

As of 2025, Zelle has implemented several updates to enhance user experience while also addressing common Zelle transaction problems. Users can enjoy enhanced tracking for each payment, which comes in handy when revisiting past transactions. Familiarizing yourself with recent guidelines for Zelle payments is suggested to ensure maximum efficiency and security while making transactions. Regularly check Zelle FAQs for additional insights and modifications to the process.

A Guide to Review Your Zelle Transaction History

Having access to your Zelle transaction details is vital in case you encounter any issues or if you wish to reverse a Zelle transfer. Most banks provide you with online banking options to review transaction histories. By keeping track of your Zelle payments diligently, you will easily identify transactions that require cancellation or correction.

Steps to Cancel a Zelle Transaction

When you need to cancel a Zelle transaction, there are specific methods and procedures you should follow. Fortunately, reversing a Zelle payment is straightforward, provided certain conditions are met. Whether your payment is pending or has already been processed impacts how you can approach canceling it. Below are steps to effectively manage your Zelle payments and cancel them when necessary.

Canceling Pending Zelle Payments

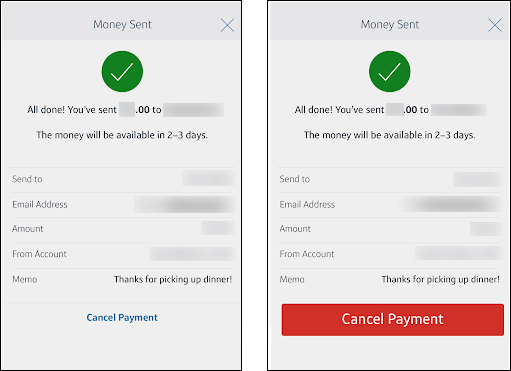

If your Zelle payment is still pending, the process of cancellation is typically easier. To stop a pending Zelle payment, open your banking app or the Zelle app, review your transaction history, and find the specific payment in question. There, you will see the option to cancel the payment immediately. Ensure that you follow all prompts and confirm the cancellation to complete the process. This method prevents funds from being transferred to the recipient, thus avoiding any issues.

What to Do After Sending a Successful Zelle Payment

Sending a payment without proper verification can lead to the need for a refund. If the payment has been completed, you can initiate the Zelle refund process. Start by contacting your bank’s support or using the app to submit a refund request. Each bank has its own regulations for refund requests, so be ready to provide transaction details for better assistance. Keep an eye on the timeline it takes for funds to be refunded, following your bank’s outlined procedure.

Seeking Help with Zelle Payment Issues

If issues arise with a payment, or if you don’t receive the expected funds, it’s essential to know how to contact Zelle support effectively. Make use of the Zelle help center or reach out to your bank’s customer service for assistance. Having findings ready—such as transaction details and payment confirmations—will help expedite the issue resolution process. Ensure open communication to tackle misunderstandings concerning Zelle payments.

Best Practices for Managing Zelle Payments

To prevent future issues with Zelle, employing strategies for effective management is crucial. Understanding the risks associated with digital payments can help you navigate and use Zelle safely. Below are some essential tips that will lend you a smoother experience with Zelle payments.

Using Zelle Responsibly to Prevent Errors

When using Zelle, ensure that you double-check the recipient’s information before completing a transaction. Accidental payments can happen, and reversing them can be a hassle. Verify the phone number or email address associated with the transaction is correct. This practice goes a long way in preventing the need to dispute Zelle payments or cancel transactions entirely.

Benefits of Monitoring Your Zelle Account

Keeping track of your Zelle account and its transactions helps you avoid potential issues. Regularly reviewing your transaction history makes it easier to spot unauthorized transactions or discrepancies. Moreover, this promotes good financial management habits and leads to timely responses when issues arise with your Zelle payments.

Stay Informed with Zelle Updates

As financial technologies continue to evolve, so do payment applications like Zelle. Stay up-to-date with the latest updates via the Zelle app features. Following news and community forums regarding Zelle can help you learn about common problems and their solutions, further guiding your approach to using Zelle securely.

Key Takeaways

- Understand the Zelle payment procedures and how to manage your transactions effectively.

- Cancel pending Zelle transactions easily via your banking app.

- Stay informed of the latest updates and security measures for Zelle payments.

- Contact your bank for any issue resolution regarding Zelle transactions.

- Adopt good financial practices to minimize risks while using digital payment methods.

FAQ

1. How long does it take to receive a Zelle refund?

The timeframe for receiving a refund from Zelle can vary based on your bank’s policies. Generally, transaction cancellations might process within minutes, whereas refunds can take 3-5 business days. Always check with your bank for precise timelines.

2. What if I sent money to the wrong person on Zelle?

If you accidentally sent money to the wrong recipient, you should try to contact the person immediately and request a refund. If your request is ignored, you can report it to your bank and follow the established Zelle payment cancellation steps.

3. Can I dispute a Zelle payment?

Yes, you can dispute a Zelle payment, especially if unauthorized charges are detected. Contact your bank or Zelle customer support for the necessary steps to formally dispute the transaction.

4. Are there limits on Zelle transactions?

Yes, each bank has its unique limits on Zelle transactions, which can range from daily to monthly caps. It’s advisable to check with your financial institution for specific details regarding Zelle limits.

5. What security measures should I adopt while using Zelle?

To ensure secure transactions, always review recipient details, enable account notifications, and monitor your transaction history. Additionally, familiarizing yourself with common Zelle fraud examples can help you stay vigilant.