“`html

Effective Ways to Calculate the Expected Value in 2025

Understanding the Expected Value Definition

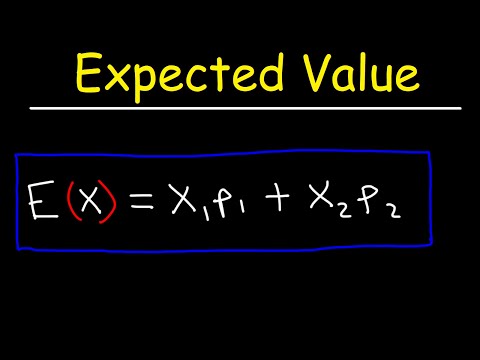

The **expected value** (EV) is a fundamental concept in statistics and probability theory, representing the anticipated average outcome of a random event. It reflects the mean value of all possible outcomes, weighted by their probabilities. To grasp the concept effectively, consider the **expected value formula**:

Expected Value (EV) = Σ (Probability of Outcome × Value of Outcome)

This highlights that each outcome’s contribution to the overall expected value is dependent on both its likelihood of occurring and its potential reward. Thus, grasping the **expected value definition** allows individuals and businesses to make informed decisions based on quantitative analysis and risk assessment.

Expected Value Formula Explained

The **expected value formula** serves as a vital tool in diverse domains such as finance, gambling, and insurance. It allows for calculating the anticipated results of different scenarios in an objective manner. For example, if an investor is considering buying a stock with a 70% chance of a $100 gain and a 30% chance of a $50 loss, they apply the formula:

EV = (0.7 × 100) + (0.3 × -50) = $70 – $15 = $55

This calculation reveals that the expected gain for this investment is $55, providing critical insight into the decision-making process.

Properties of Expected Value

The properties of expected value play a crucial role in its application across various fields. Firstly, the **expected value** is linear; the expected outcome of a sum of random variables equals the sum of their expected values. This principle aids in understanding complex systems involving multiple factors. Secondly, the EV does not necessarily provide all insights related to risk because it does not consider variance or risk preference—factors that often influence **expected value** outcomes deeply, like in investment strategies. By recognizing these properties, individuals can apply the concept more effectively in both theoretical and practical contexts.

Calculating Expected Value with Simple Examples

Calculating **expected value** involves straightforward steps that can apply to everyday scenarios. The basic principle remains the same: determine the outcomes, assign probabilities, and compute the weighted average. For instance, consider the simple game of rolling a die. The **expected value when rolling dice** can be calculated as follows:

Probability (1/6) × Outcome (1) + Probability (1/6) × Outcome (2) + … + Probability (1/6) × Outcome (6)

Given equal probabilities, the calculation results in an expected value of 3.5. This example showcases how **expected value** can guide decisions in games and probability contexts.

Expected Value Example in Gambling

<pIn the domain of gambling, calculating the **expected value** allows bettors to assess the profitability of a wager more effectively. For instance, if a roulette player bets $10 on a color with a 47.37% chance of winning $20, the **expected value in gambling** can be computed as:

EV = (0.4737 × $20) + (0.5263 × -$10) = $9.474 – $5.263 = $4.211

Thus, the player can anticipate a gain of approximately $4.21 from this bet over time, representing informed decision-making based on the EV concept.

Expected Value in Risk Assessment

In risk management, the **expected value** assists organizations in evaluating potential outcomes of their decisions. This can be particularly useful in scenarios involving uncertain factors. For example, a business may analyze the **expected value in risk assessment** when launching a new product. If there’s a 60% chance of generating $300,000 and a 40% chance of incurring a $100,000 loss, the expected profit can be calculated as:

EV = (0.6 × $300,000) + (0.4 × -$100,000) = $180,000 – $40,000 = $140,000

This expected value provides a coherent metric for guiding product launch decisions, thus optimizing resource allocation based on anticipated outcomes.

Applications of Expected Value in Various Fields

The **expected value** concept has a myriad of applications across different sectors, making it indispensable in strategic planning and decision analysis. In finance, businesses utilize **expected value in finance** to forecast returns on investments. By examining historical data and employing statistical models, investors can estimate future profit or loss probabilities.

Expected Value in Game Theory

In the realm of game theory, the **expected value** serves a pivotal role in strategizing competitive situations. Game theorists leverage **expected value in game theory** to analyze different strategies and predict the behaviors of other players based on predicted payouts. For instance, during competitive bidding, players calculate their expected values to formulate optimum bidding strategies, thus improving their chances of winning while minimizing potential losses. This mathematical underpinning is essential for successful interaction in any competitive dynamic.

Expected Value in Insurance and Finance

The concept of **expected value in insurance** allows companies to evaluate risk and set premiums. Insurers calculate expected losses to ascertain whether they can cover claims, weighing potential payouts against collected premiums. Similarly, analysts look at **expected value for investments** by balancing potential profit against risks, guiding portfolio choices that maximize returns. Clients often benefit from strategies derived through the lens of **expected value** when evaluating multiple investment opportunities.

Maximizing Expected Value for Decision Making

To make the most out of the **expected value**, decision-makers focus on technologies that enhance prediction capabilities. By integrating existing data and employing computational methods like **Monte Carlo simulation**, companies can project outcomes more precisely, allowing for **maximizing expected value** in operations.

Expected Value in Economics

In economics, the **expected value** also plays a critical role in utility analysis. Determining the **expected value in economics** allows formulators to gauge how individual choices enable or discourage certain economic behaviors based on predicted outcomes. For example, consumers evaluate the value of products concerning their price, thus leading to decisions that maximize satisfaction, reflecting how **expected value** directly influences consumer behavior and market dynamics.

Practical Steps in Expected Value Calculation

To ensure accurate calculation of the **expected value** in any scenario, follow these systematic steps:

- Determine all possible outcomes

- Assign probabilities to each outcome

- Multiply each outcome by its corresponding probability

- Sum these values to arrive at the **expected value**

Adhering to these steps ensures robust decision-making based on anticipated returns, critical across domains from finance to risk assessment.

Key Takeaways

- The **expected value** is an essential statistical concept used across various fields for average outcome prediction.

- Understanding the **expected value formula** and its properties allows for informed decision-making.

- While calculating **expected value**, consider different probabilities and outcomes for accurate forecasts.

- In contexts from gambling to investments, **expected value** remains critical for optimizing profitability and risk management.

- Adopting systematic steps enhances the accuracy of the **expected value** calculation.

FAQ

1. How is **expected value** used in decision theory?

In decision theory, the concept of **expected value** assists individuals in evaluating various choices under uncertainty. By calculating the expected outcomes of different alternatives, decision-makers can choose the option with the highest expected return, integrating risk assessment effectively.

2. What are the challenges in calculating **expected value in real life scenarios**?

Calculating **expected value in real life scenarios** often involves dealing with complex probabilities and multiple variables. The uncertainty associated with predicting outcomes, potential bias in estimating probabilities, and fluctuations in market or environmental conditions can complicate accurate expected value computation.

3. How to find expected value when considering joint probabilities?

To find **expected value** when considering joint probabilities, utilize the rule of total probability. Calculate the expected outcomes for each event and subsequently combine them using their corresponding probabilities. This multi-step approach ensures comprehensive consideration while keeping processes precise.

4. What role do **expected losses** play in expected value calculations?

**Expected losses** are integral to overall calculations when evaluating the **expected value**. By weighing potential losses against potential benefits, decision-makers can better understand risk and inform strategies that mitigate negative outcomes while maximizing profitability.

5. Can the expected value be negative, and what does it imply?

Yes, the **expected value** can be negative, indicating an expected loss rather than a gain. Investors or decision-makers observing negative expected value must reconsider their strategies or investments to address potential risks or reallocate resources more effectively.

6. How can **expected value distribution** affect statistical predictions?

The **expected value distribution** impacts statistical predictions by defining the likelihood and variance of different outcomes. Understanding how probabilities are distributed among the expected values helps analysts make better forecasts and recommendations in complex scenarios.

7. What is the significance of the difference between **expected value vs actual value**?

The difference between **expected value vs actual value** is significant as it reflects the disparity between predicted outcomes and real-world results. Assessing this variance enables businesses and analysts to refine their models and improve future predictions, enhancing the efficacy of decision-making processes.

“`