How to Properly Sign a Check Over to Someone Else in 2025

In today’s financial landscape, understanding how to sign a check over properly is essential for seamless transactions, especially when transferring funds to another person. Whether you are endorsing a check to a friend or family member, understanding the legal check transfer rules is crucial in ensuring that the transaction proceeds smoothly. In this guide, we will explore the check signing process, including practical steps, legal implications, and common mistakes to avoid.

Understanding Check Endorsement

Check endorsement is the act of signing the back of a check to transfer the funds to another person or entity. This process allows the original payee (the person to whom the check is made out) to endorse a check, enabling another party to cash or deposit it. When it comes to **signing a check**, there are specific guidelines to ensure that the transaction is valid and complies with check endorsement rules. Following these guidelines minimizes the risk of check fraud and enhances the **validity of endorsed checks**.

Steps to Endorse a Check

When you need to transfer funds via check, follow these steps for **endorsing checks for others** properly:

- Examine the Check: Ensure the check is properly filled out and that your name is accurately listed as the payee.

- Prepare to Endorse: Turn the check over to its back. This is where the endorsement usually occurs.

- Write “Pay to the Order of: This phrase allows you to specify who the check is to be transferred to. Write the name of the person receiving the check.

- Sign Your Name: Below the “Pay to the Order of” line, sign your name as it appears on the front of the check.

- Provide Additional Information: Consider adding any identification or contact details if required by your bank, especially for third-party check endorsements.

Following these steps ensures that you’re securely transferring ownership of the check and complying with **check endorsement guidelines**.

Common Mistakes to Avoid in Check Signing

Understanding how to sign a check over includes knowing common pitfalls to avoid. A frequent **check endorsement mistake** is failing to specify who the check is being endorsed to, which can lead to confusion and potential disputes. Additionally, ensure you are not signing a check over to anyone who may not have the right to cash it, as this could yield legal implications of signing a check incorrectly and affect the enforceability of endorsed checks.

Check Cashing Process for Endorsed Checks

Once you’ve successfully endorsed the check, ensure you are aware of how the check cashing process works. Different banks, and even cashing services, may have varying policies regarding endorsed checks. When cashing an endorsed check, it often requires you or the recipient to show valid identification that matches the name on the front of the check. Additionally, some banks may impose check cashing limits, particularly for **third-party check regulations**. Always check with the respective financial institution for specific **bank policy on endorsed checks** before proceeding.

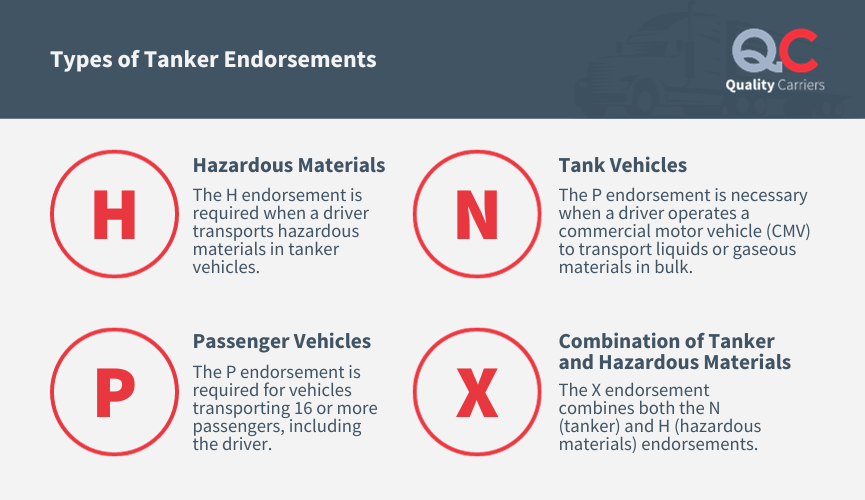

Types of Endorsements

There are various **check endorsement types** that you should be familiar with when signing a check over. Delivering an understanding of these types not only enhances your confidence but also ensures adherence to necessary protocols.

Blank Endorsement

The most common form of endorsement is the blank endorsement. To execute this, the endorser simply signs the back of the check without specifying a payee. This makes the check bearer negotiable between parties; however, it’s essential to handle blank endorsements carefully, as it can be cashed by anyone in possession of the check. This type of endorsement usually comes with risks, particularly regarding check fraud.

Restrictive Endorsement

A restrictive endorsement restricts the funds from being transferred for purposes beyond what is specified. For instance, you can endorse a check to be deposited into a bank account only by writing “For Deposit Only” followed by your signature beneath it. This form of endorsement provides an added layer of security, ensuring that the check cannot be cashed directly, which is particularly beneficial if you’re unsure of the integrity of the new payee.

Special Endorsement

Lastly, a special endorsement allows the payee to specify who can cash the check. By signing “Pay to the order of [New Payee’s Name]” followed by your signature, you’re specifically directing where the payment goes. This is particularly useful when transferring ownership of a check to ensure clarity concerning the check transaction process.

Legal Implications of Signing a Check Over

When discussing how to properly sign a check over to someone else, it’s crucial to grasp the legal **implications of signing a check**. By endorsing a check, you are not just transferring funds; you may be altering the legal status of the document itself. Understanding these implications ensures all parties involved are protected.

Enforceability of Endorsed Checks

Endorsed checks should maintain enforceability within their respective financial environments. As long as the endorsement adheres to established laws and the **check transfer guidelines**, the endorsed checks remain valid for cashing or deposit. Ensure that transactions comply with legal standards to avoid complications.

Risks Associated with Endorsing a Check

Endorsing previously established checks comes with risks that need to be recognized. Transfer agreements must be clearly understood by all parties to avoid the possibility of fraud. Additionally, issues can arise if recipient identification is insufficient or if financial institutions have policies against processing endorsed checks under certain circumstances. Be sure to adhere robustly to **check endorsement processes** and respect legal frameworks governing checks in your state.

Requirements for Valid Endorsements

To ensure your endorsed check is valid and acceptable for cashing or deposit, it’s important to be aware of the requirements for authorized **signature requirements for checks**. Most banks require a genuine signature matching that of the payee listed on the check. Furthermore, providing additional documentation, including identification, can reinforce the legitimacy of your endorsement.

Key Takeaways

- Endorse checks accurately to avoid legal complications and increase the validity of endorsed checks.

- Understand the different types of endorsements and choose the one that meets your needs.

- Be aware of the bank policies regarding endorsed checks for successful cashing or depositing.

- Recognize the risks associated with check endorsements and adhere to best practices for secure transactions.

FAQ

1. How do I properly endorse a check to someone else?

To properly endorse a check, write “Pay to the Order of [Name of the Person]” on the back, followed by your signature. Ensure the new payee is aware of the check you’re transferring so they can cash or deposit it without issue.

2. What legal problems can arise from transferring checks?

Legal implications can include fraud risks, disputes regarding ownership, and issues concerning enforceability if proper endorsement procedures are not followed. Always discuss and confirm details with your financial institution.

3. Can anyone cash a signed-over check?

Yes, anyone holding an endorsed check can theoretically cash it, but varying institution policies require identification from the cashing party. It’s advisable to ensure that the endorsee potentially avoiding issues.

4. What happens if a bank denies my endorsed check?

If denied, the bank usually communicates the issues related to the endorsement, which could be due to discrepancies in signatures or failure to meet endorsement requirements. Always ensure you meet signature requirements for checks.

5. Are there specific identification requirements for cashing endorsed checks?

Yes, banks often require valid identification from the person cashing the check. Make sure that ID corresponds with the signed endorsement to prevent any denial during processing.

6. What are third-party checks, and how are they different?

Third-party checks are checks endorsed to a different person than the one they were issued to. Cashing these checks typically requires clear identification and adherence to banks’ unique policies.

7. Can I trust all banks to cash endorsed checks?

No, trustworthiness can vary among banks in terms of **check cashing services**. It’s essential to consult your financial institution’s check policies regarding endorsed checks before attempting to cash one.