Effective Ways to Calculate Consumer Surplus in 2025

Understanding how to calculate consumer surplus is essential for evaluating economic efficiency and welfare in various markets. In 2025, as market dynamics evolve, it becomes crucial to employ effective strategies for measuring this key economic concept. This article will guide you through practical tips and methods to effectively assess consumer surplus, illustrating the significance of various economic principles and tools.

The Importance of Understanding Consumer Surplus

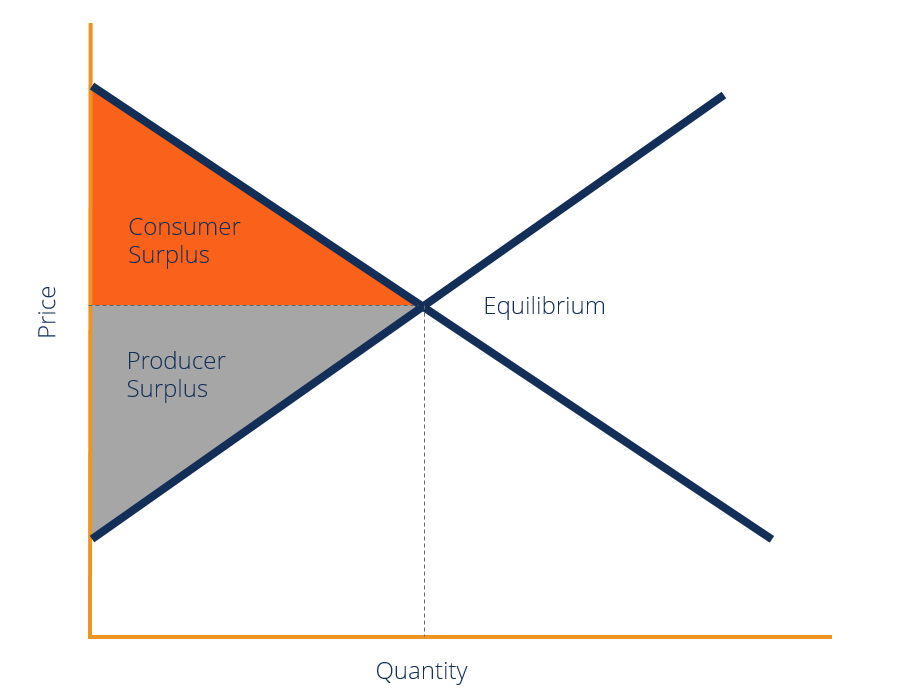

Consumer surplus is an integral measure that represents the difference between what consumers are willing to pay for a good or service and what they actually pay. Essentially, it provides insights into consumer behavior and highlights the value derived from a transaction beyond the market price. By understanding consumer surplus, businesses can refine their strategies to boost consumer welfare and overall economic efficiency. Through proper calculation, firms can align their pricing mechanisms to better meet consumer demand, ultimately enhancing market stability.

Understanding the Consumer Surplus Formula

The formula for calculating consumer surplus, expressed mathematically, can aid in efficient evaluations. The basic formula is:

Consumer Surplus = 1/2 × Base × Height

Where the base represents the quantity sold and the height represents the difference between the highest price consumers are willing to pay (demand curve) and the market price (supply curve). Using this approach allows businesses to visualize the consumer surplus graph and recognize its significance in fostering market equilibrium. Analytical skills around this formula support strategic decisions such as pricing adjustments and inventory management.

Example of Consumer Surplus Calculation

To better grasp consumer surplus, let’s consider a practical example. Assume a market selling organic apples where the demand curve indicates consumers are willing to pay $3 per apple, but the market price is set at $2. The quantity sold is 100 apples. Thus, the calculate consumer surplus can be demonstrated as follows:

1. **Determine Willingness to Pay**: Consumers are willing to pay $3 yet pay only $2. This gives a difference of $1 which is the height in our formula.

2. **Base**: Given at 100 apples.

3. **Plugging into the Formula**: Consumer Surplus = 1/2 × 100 × 1 = $50.

This example illustrates how evaluating consumer surplus not only aids in revenue calculations but also provides insights into a business’s ability to enhance consumer satisfaction.

Factors Influencing Consumer Surplus

Several factors can impact the calculation and interpretation of consumer surplus, disease-non-conduit, accurately assessing market dynamics leading to enhanced consumer insights. Recognizing these influences is vital for adapting strategies effectively.

Price Elasticity of Demand

A key factor influencing consumer surplus is the price elasticity of demand, which measures how much demand changes in response to price changes. Higher elasticity implies that small price changes can significantly impact consumer behavior. For example, if the price of a product drops quickly, consumer surplus may increase considerably as more individuals are willing to purchase it at the lower price. Awareness of these elasticity dynamics is crucial for businesses aiming to maximize market efficiency.

Market Pricing Strategies

Pricing strategies profoundly impact consumer surplus as well. Strategies such as dynamic pricing or price discrimination can alter consumer satisfaction levels. Consider a scenario where the price for a specific line of products varies by customer segment; this can lead to an increase in producer surplus while still allowing the business to create ‘targeted’ consumer surplus and cater to diverse consumer preferences effectively.

Implications of Market Equilibrium

Market equilibrium plays a critical role in determining the consumer surplus. When supply meets demand, consumers can purchase goods at the market price, which optimizes consumer welfare and market dynamics. A well-balanced market ensures a maximum number of consumers can enjoy surplus benefits, thus contributing to the overall total surplus in the economy. Understanding the forces at play in market equilibrium allows businesses to adjust their supply and pricing structures to optimize their reach, aligning effectively with consumer choice.

Challenges in Calculating Consumer Surplus

Calculating consumer surplus, while essential, can also encapsulate several challenges. Overcoming these challenges involves awareness and adaptability in economic contexts.

Consumer Preferences and Demand Shifts

Shifts in consumer preferences can obscure accurate calculations of consumer surplus. As trends change, consumers’ willingness to pay can fluctuate, possibly impacting previously established consumer surplus estimates. Analytics in demand shifts through market research are essential to update strategies accordingly, ensuring a focus on retaining consumer loyalty while managing resource allocation effectively.

Behavioral Economic Factors

Additionally, considerations of behavioral economics reveal that traditional models of utility maximization do not always apply uniformly across different consumer segments. For example, some consumers may exhibit irrational purchasing behaviors influenced by brand loyalty or social trends, ultimately affecting their willingness to pay. Businesses promising strong consumer engagement strategies will succeed in understanding and adapting to these nuances, solidifying their market positions long term.

Key Takeaways

- Consumer surplus measures the difference between willingness to pay and market price, serving as an essential indicator of economic welfare.

- Factors like price elasticity and market strategies play pivotal roles in determining consumer surplus.

- Behavioral economics adds complexity to traditional calculations, representing the need for adaptable business strategies.

FAQ

1. What is consumer surplus?

Consumer surplus is an economic measure of consumer satisfaction calculated as the difference between what consumers are willing to pay for a good and what they actually pay. It reflects the additional benefit enjoyed by consumers when they purchase products at a market price lower than their maximum willingness to pay.

2. How does price elasticity affect consumer surplus?

Price elasticity significantly influences consumer surplus because it determines how responsive consumers are to price changes. If demand is elastic, a small price decrease can lead to a large increase in quantity demanded, thereby boosting consumer surplus. Conversely, inelastic demand diminishes the impact of price changes on consumer surplus.

3. Can consumer surplus be negative?

No, consumer surplus cannot be negative. It can be zero when the price of a product equals the maximum price a consumer is willing to pay, but surplus indicates net positive economic benefit. If consumers consistently pay more than their maximum willingness to pay, they will likely choose not to purchase, driving market adjustments.

4. How does consumer surplus relate to market equilibrium?

Consumer surplus is maximized at market equilibrium where supply matches demand. At this point, consumers pay a price equal to their maximum willingness to pay while enjoying the advantages of purchasing at that equilibrium price, optimizing total economic welfare.

5. What strategies can improve consumer surplus?

To improve consumer surplus, businesses can adopt targeted pricing strategies, consider consumer behavior analyses, and ensure marketing reflects current consumer preferences. By ensuring resonance with customers’ needs and adjusting supply or marketing effectively, businesses can enhance overall consumer satisfaction.