“`html

Effective Ways to Find Marginal Cost

The concept of marginal cost is vital in economics as it helps businesses and decision-makers analyze the cost associated with producing one additional unit of a product or service. In this comprehensive guide for 2025, we’ll explore effective methods for calculating marginal cost, its implications in business decision-making, and how it compares to average and fixed costs. We will also examine the marginal cost formula, various strategies to optimize costs, and practical applications across different industries. Let’s start by defining marginal cost and its critical attributes.

Understanding Marginal Cost

To effectively manage costs in business, it’s important to grasp the definition of marginal cost. Marginal cost refers to the change in total cost when producing one additional unit of a good. It is calculated by taking the change in total cost and dividing it by the change in output. For example, if increasing production from 100 to 101 units raises total costs from $1,000 to $1,020, the marginal cost of the 101st unit is $20. This calculation is essential for making informed pricing and production decisions.

Components of Marginal Cost

The marginal cost formula can be expressed as follows: MC = ΔTC / ΔQ, where ΔTC represents the change in total cost and ΔQ signifies the change in quantity produced. An understanding of marginal costs extends beyond basic calculus; several factors influence it, including fixed costs, variable costs, and production efficiency. As production scales, these costs may fluctuate, impacting overall business profit margins. A clear grasp of these components is necessary for effective marginal cost analysis.

Importance of Marginal Cost in Economics

The significance of marginal cost in economics cannot be overstated. It provides crucial insights for businesses regarding cost management and pricing strategies. Marginal cost allows businesses to detail their cost structures and determine the optimal price points for profitability. Moreover, it is instrumental in analyses that guide investment decisions and operational efficiencies. Utilizing this analysis helps businesses in exploring economies of scale, where average costs may decrease as production increases.

Marginal Cost Calculations in Business

For any enterprise, marginal cost in business plays a key role in production planning and resource allocation. Understanding how to accurately calculate and interpret these costs helps businesses navigate complex market dynamics. Techniques for calculating marginal costs can vary, but often involve standard accounting practices and production forecasting. Additionally, the integration of marginal cost strategies can lead to significant operational improvements.

Methods for Calculating Marginal Cost

There are several marginal cost calculation methods, each serving a specific purpose. The most straightforward method is the aforementioned formula that uses total cost changes. Another method is using cost accounting techniques to allocate fixed and variable costs comprehensively. For instance, allocating overhead costs can provide more accurate marginal cost evaluations. Furthermore, businesses may leverage tools like break-even analysis and variable cost estimations to assess costs effectively, ensuring they achieve maximum profitability.

Case Study: Marginal Cost Optimization

Let’s consider a practical application of marginal cost through a hypothetical case study. A manufacturer of athletic shoes notices that producing an extra 1,000 pairs costs $25,000, while improving production efficiency might reduce this to $20,000. By adjusting manufacturing processes and investing in staff training, the company discovered a clear opportunity for marginal cost optimization</strong>. By understanding the shifts in their marginal cost curve, they strategically increased output while lowering overall production costs, demonstrating the importance of continuous analysis in achieving marginal cost efficiency.

Marginal Cost vs Fixed Cost

In addition to understanding marginal cost, it’s essential to comprehend the distinction between marginal cost and fixed cost. While marginal cost is a variable expense incurred for each additional unit produced, fixed costs remain the same regardless of production levels. Examples of fixed costs include rent and salaries, which do not fluctuate with production volume. Understanding this discrepancy helps decision-makers gauge the overall cost structure and plan capacity adjustments that enhance operational efficiency.

Factors Influencing Marginal Cost

Several factors affect marginal costs, such as labor costs, production techniques, and raw material prices. For instance, utilizing technology can reduce labor costs per unit, thereby decreasing the marginal cost. Additionally, changes in supply chain dynamics, fluctuations in demand, or operational inefficiencies can also lead to significant changes in marginal cost. Businesses must keep these factors in mind to adapt pricing strategies and maintain profitability as market conditions fluctuate.

Marginal Cost Trends in Finance

Consistent monitoring of marginal cost trends is key in financial analysis. Businesses today face rapid changes in market forces—technology advancements, economic shifts, and competition are all factors that directly impact production economics. By analyzing historical marginal cost data, companies can predict future behavior and prepare for fluctuations. Such analysis fosters better allocation of resources, ultimately contributing to financial resilience and understanding of cost drivers essential in financial modeling.

Key Takeaways

- Understanding and calculating marginal cost is essential for effective decision-making in business.

- Accurate marginal cost assessments can guide pricing strategies and production planning.

- Continuous monitoring of cost structures can yield insights into operational efficiencies and financial health.

FAQ

1. What is the marginal cost curve?

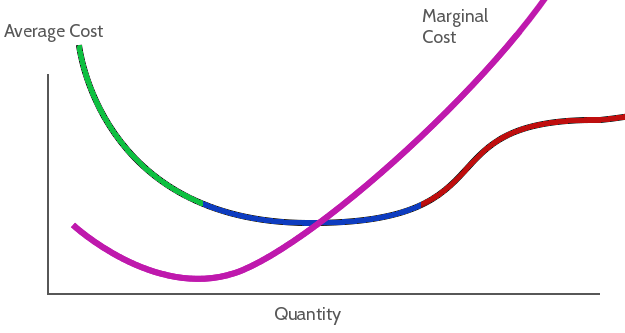

The marginal cost curve represents the graphical depiction of the relationship between marginal cost and output levels. As production increases, marginal costs may initially decrease due to efficiency; however, they may eventually rise due to diminishing returns. This visualization aids businesses in understanding how costs change with production and helps optimize resource allocation.

2. How is marginal cost related to average cost?

Marginal cost and average cost are closely associated, yet distinct. The marginal cost reflects the cost of producing one additional unit, while average cost is total production cost divided by total output. When the marginal cost falls below the average cost, it can decrease the average cost over time. Understanding this relationship is vital for pricing strategies and maximizing profitability.

3. What is the importance of assessing changes in marginal cost?

Assessing changes in marginal cost is crucial for businesses to identify trends that affect profitability. Knowing how marginal costs fluctuate enables companies to adjust production optimization strategies, conceive effective pricing, and remain competitive in the marketplace. Constant evaluation fosters improved cost management and financial decision-making.

4. How do businesses optimize marginal cost?

Optimizing marginal cost involves streamlining production processes, investing in technology, and enhancing workforce capabilities. By conducting regular cost-benefit analyses and maintaining agile operations, businesses can effectively lower their marginal costs while boosting profit margins. Techniques like just-in-time production and efficient resource allocation further contribute to this optimization.

5. What is the relationship between marginal cost and revenue?

The relationship between marginal cost and revenue is foundational in determining pricing strategies and production levels. Essentially, when a company’s marginal revenue exceeds marginal cost, it can justify increasing production for greater profitability. Conversely, if marginal cost surpasses marginal revenue, it may indicate the need to reassess production decisions to avoid losses.

“`